Mortgage Calculator USA – Free Home Loan Calculator to Estimate Monthly Payments

Buying a home in the United States is one of the biggest financial decisions you will ever make. Before applying for a home loan, it is essential to understand how much you can afford and what your monthly mortgage payments will look like. This is where a Mortgage Calculator USA becomes an extremely valuable tool.

A mortgage calculator helps you estimate your monthly mortgage payment, including principal, interest, taxes, and insurance. Whether you are a first-time home buyer, refinancing your existing loan, or investing in property, using a mortgage calculator can save time and help you make smarter financial decisions.

What Is a Mortgage Calculator?

A mortgage calculator is an online tool that allows you to estimate your home loan payments based on key factors such as:

- Home purchase price

- Down payment amount

- Loan term (15-year or 30-year mortgage)

- Interest rate

- Property taxes

- Homeowners insurance

Using a mortgage calculator USA, you can instantly see how different loan options affect your monthly payment and long-term cost.

Why Use a Mortgage Calculator USA?

Using a mortgage calculator before applying for a home loan offers many benefits:

1. Estimate Monthly Mortgage Payments

A monthly mortgage payment calculator helps you understand how much you will pay every month, making budgeting easier.

2. Compare Loan Options

You can compare 30-year fixed mortgage rates, 15-year mortgage payments, and adjustable-rate mortgages to find the best option.

3. Plan Your Budget Better

Knowing your estimated payment helps you avoid financial stress and choose a home within your budget.

4. Understand Interest Costs

A mortgage calculator shows how much interest you will pay over the life of the loan.

How Does a Mortgage Calculator Work?

A home loan calculator USA uses a standard mortgage formula to calculate your payment. The calculation is based on:

- Loan amount (home price minus down payment)

- Interest rate

- Loan term

- Taxes and insurance (if included)

The result gives you an estimated monthly mortgage payment, helping you understand your real housing cost.

Mortgage Calculator USA – Example

Let’s say:

- Home price: $350,000

- Down payment: $70,000

- Loan amount: $280,000

- Interest rate: 6.5%

- Loan term: 30 years

Using a mortgage calculator with interest, your estimated monthly payment could be around $1,770, excluding taxes and insurance.

This simple calculation shows why using a calculator is essential before committing to a loan.

Types of Mortgage Calculators in the USA

1. Monthly Mortgage Payment Calculator

Calculates your monthly payment based on loan details.

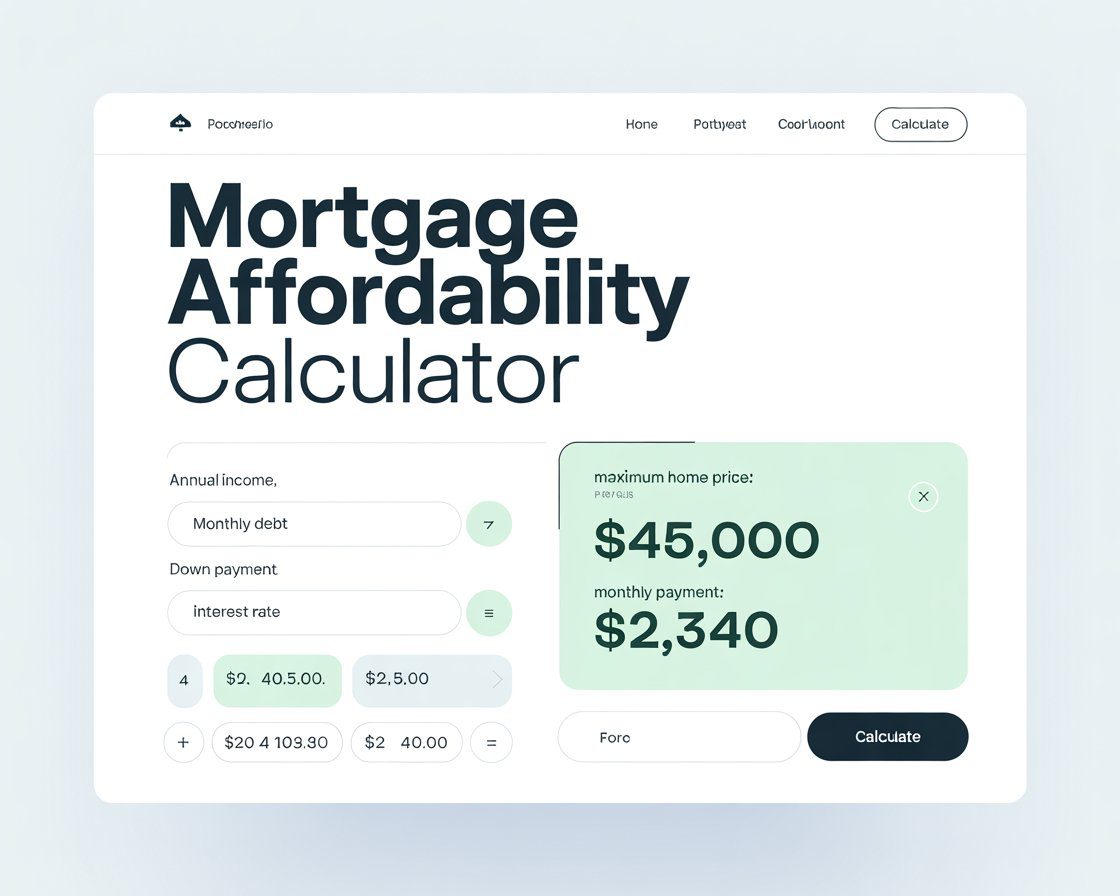

2. Mortgage Affordability Calculator

Answers the popular question: “How much house can I afford?”

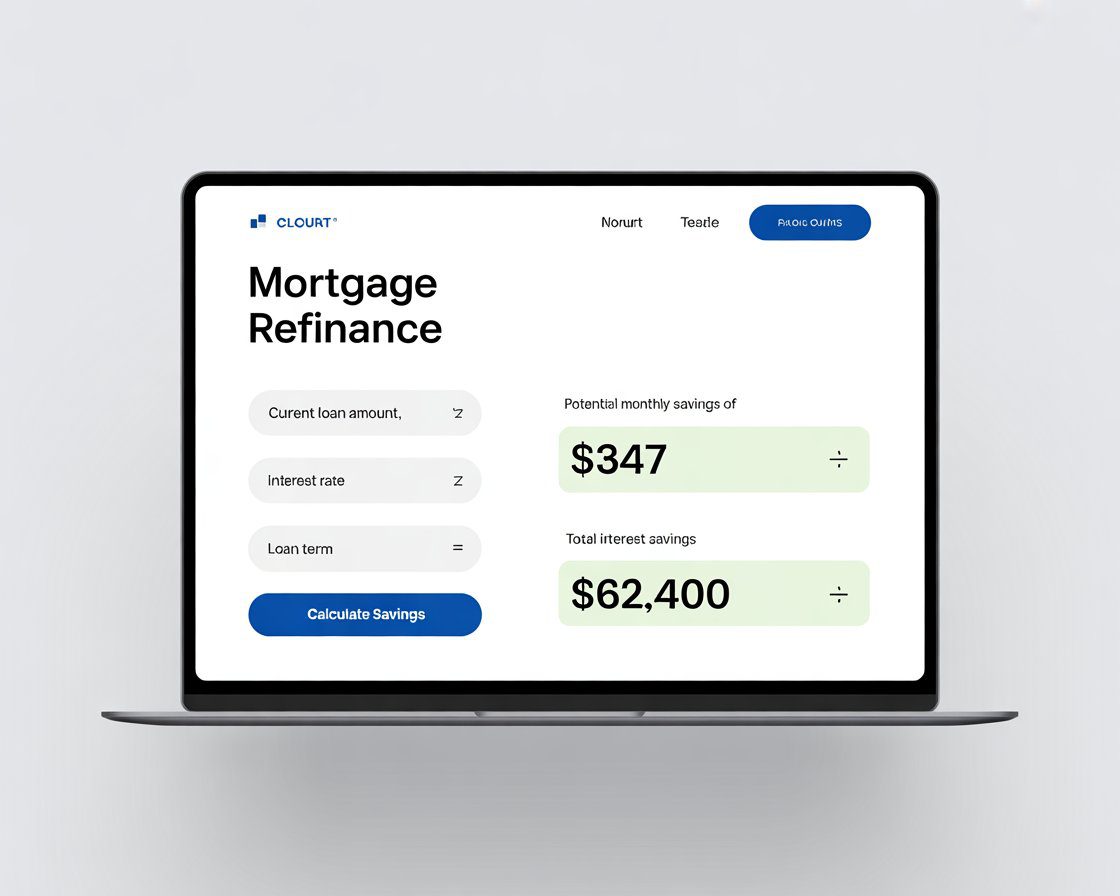

3. Refinance Mortgage Calculator

Helps homeowners decide if refinancing can lower their payments.

4. FHA Loan Calculator

Designed for FHA loans with lower down payments.

5. VA Loan Calculator

Specifically for veterans and military families using VA loans.

Mortgage Calculator for First-Time Home Buyers

First-time buyers often struggle to understand mortgage costs. A mortgage calculator USA for first-time buyers helps by:

- Estimating affordable home prices

- Showing required down payments

- Calculating monthly payments with low credit scores

- Comparing FHA vs conventional loans

This makes the home-buying process much easier and less confusing.

Mortgage Calculator with Taxes and Insurance

Many buyers forget about additional costs. A mortgage calculator with taxes and insurance gives a more accurate estimate by including:

- Property taxes

- Homeowners insurance

- HOA fees (if applicable)

This ensures you are financially prepared for the real monthly expense.

Benefits of Using an Online Mortgage Calculator

- Free and easy to use

- Instant results

- Helps avoid loan surprises

- Supports smarter financial planning

- Ideal for comparing mortgage rates USA

Using a calculator before talking to a lender gives you confidence and negotiation power.

Mortgage Calculator USA and Mortgage Rates

Mortgage rates in the USA change frequently. A current mortgage rates calculator helps you see how rate changes affect your payment.

Even a small interest rate difference can save or cost you thousands of dollars over the loan term. That’s why using a calculator is essential when monitoring today’s mortgage rates.

Are Mortgage Calculators Accurate?

Mortgage calculators provide estimates, not exact numbers. Final loan payments depend on lender fees, credit score, and loan approval terms. However, calculators are extremely helpful for planning and comparison.

Final Thoughts

A Mortgage Calculator USA is one of the most powerful tools for anyone planning to buy or refinance a home. It helps estimate monthly payments, compare loan options, and understand long-term costs before speaking with a lender.

If you want to make informed decisions, avoid financial surprises, and choose the best home loan option, using a mortgage calculator is the smartest first step.

Post Comment