Home Loan Calculator with Interest – Calculate Your Monthly Mortgage Payments Accurately

Buying a home is a major financial decision, and understanding your loan costs is essential before applying for a mortgage. A Home Loan Calculator with Interest is one of the most useful tools for home buyers and homeowners in the United States. It helps you calculate your monthly mortgage payment, total interest cost, and overall loan affordability.

By using a home loan calculator with interest, you can make smarter financial decisions, compare loan options, and avoid unexpected expenses. Whether you are a first-time home buyer or planning to refinance, this tool gives you a clear picture of your mortgage payments.

What Is a Home Loan Calculator with Interest?

A Home Loan Calculator with Interest is an online tool that estimates your mortgage payments by including the interest rate along with the loan amount and loan term. Unlike basic calculators, this tool shows how interest impacts your monthly payment and the total cost of the loan over time.

It typically considers:

- Home purchase price

- Down payment amount

- Loan amount

- Interest rate

- Loan term (15-year or 30-year mortgage)

This calculator helps you understand how much interest you will pay and how it affects your long-term finances.

Why Use a Home Loan Calculator with Interest?

Using a home loan calculator with interest USA provides several important benefits:

1. Accurate Monthly Payment Estimates

You can calculate your monthly home loan payment with interest before applying for a mortgage.

2. Understand Total Interest Cost

The calculator shows how much interest you will pay over the life of the loan.

3. Compare Loan Options

Compare different interest rates, loan terms, and down payment amounts to find the best mortgage option.

4. Better Financial Planning

Knowing your total loan cost helps you budget and plan confidently.

How Does a Home Loan Calculator with Interest Work?

A home loan interest calculator uses a standard mortgage formula that takes into account:

- Loan principal (purchase price minus down payment)

- Annual interest rate

- Loan term in years

The calculator then breaks down the payment into principal and interest, showing how much you pay each month and over the full loan period.

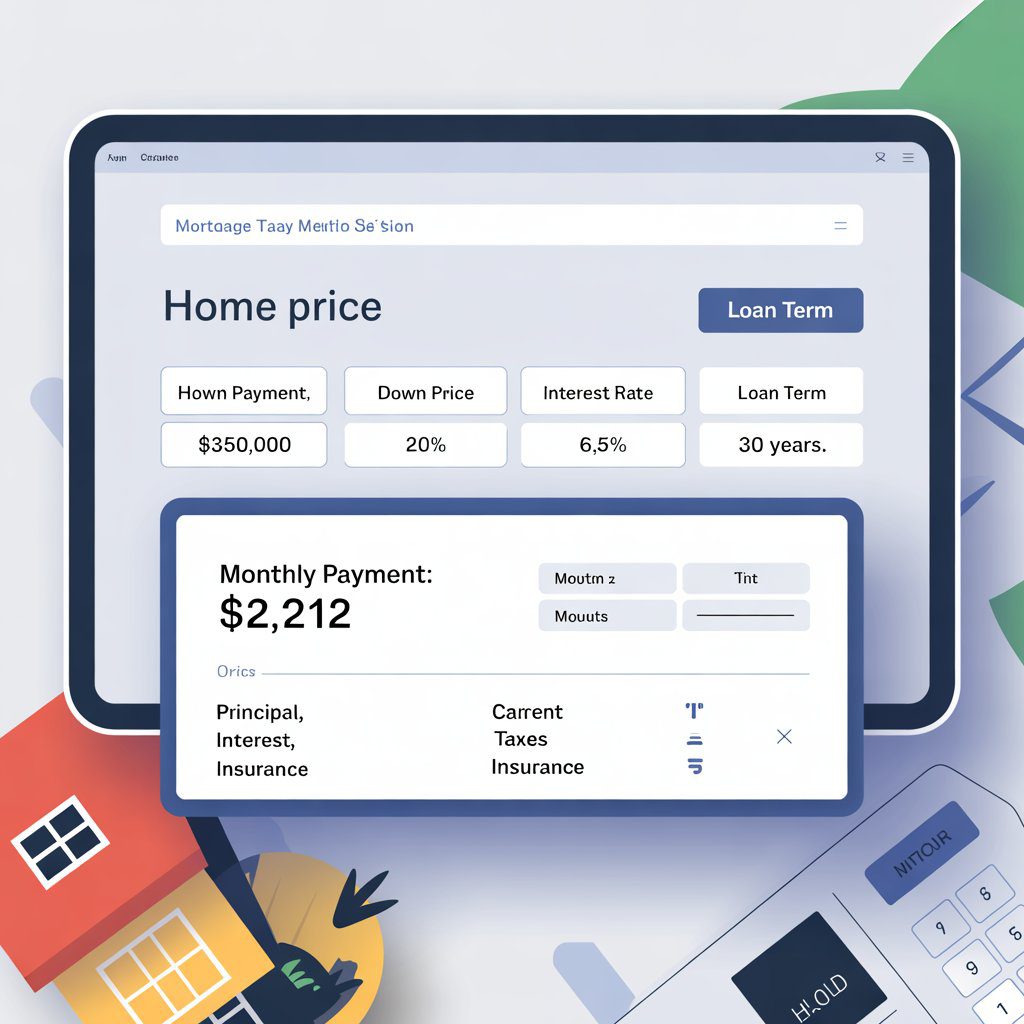

Home Loan Calculator with Interest – Example

Here is a simple example:

- Home price: $400,000

- Down payment: $80,000

- Loan amount: $320,000

- Interest rate: 6.75%

- Loan term: 30 years

Using a home loan calculator with interest, your estimated monthly mortgage payment would be around $2,075 (principal and interest only).

This example clearly shows how interest rates significantly affect your monthly payment and total loan cost.

Key Factors That Affect Home Loan Interest Calculations

1. Interest Rate

Mortgage interest rates have the biggest impact on your monthly payment and total interest paid.

2. Loan Term

A 30-year loan has lower monthly payments but higher total interest, while a 15-year loan saves interest but costs more monthly.

3. Down Payment

A higher down payment reduces your loan amount and interest cost.

4. Credit Score

Higher credit scores usually qualify for lower mortgage interest rates.

Types of Home Loan Calculators with Interest

1. Fixed-Rate Home Loan Calculator

Calculates payments for fixed-rate mortgages.

2. Adjustable-Rate Mortgage (ARM) Calculator

Estimates payments that may change over time.

3. FHA Home Loan Calculator with Interest

Designed for FHA loans with lower down payments.

4. VA Home Loan Calculator

For eligible veterans and military families.

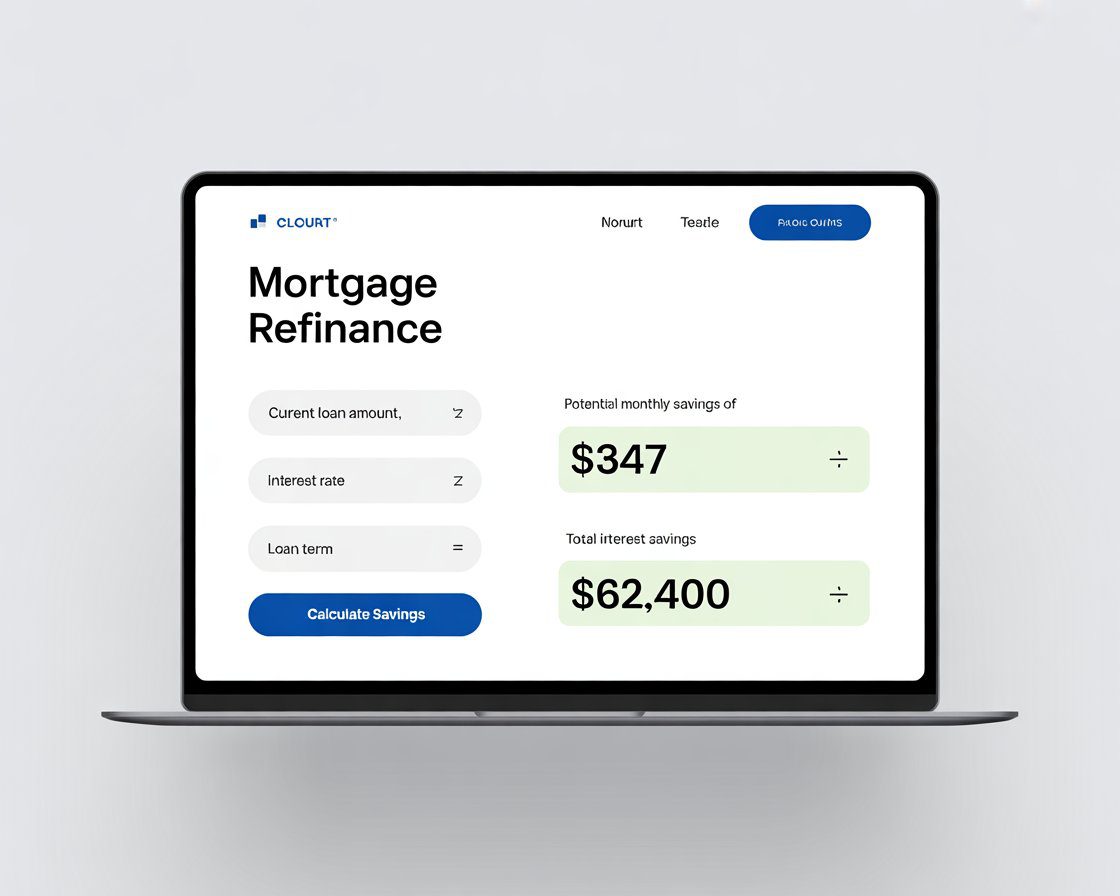

5. Refinance Home Loan Calculator with Interest

Helps homeowners decide if refinancing can reduce interest costs.

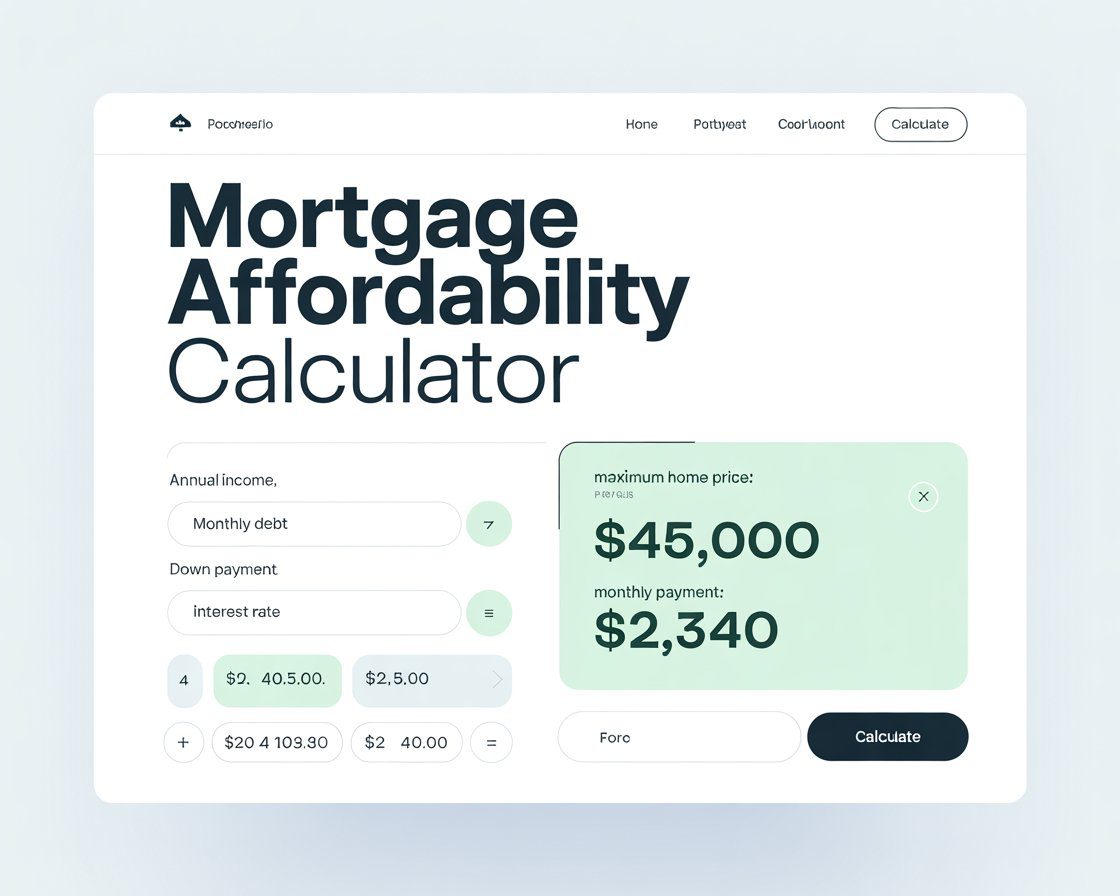

Home Loan Calculator with Interest for First-Time Home Buyers

First-time buyers often underestimate interest costs. A home loan calculator with interest for first-time buyers helps by:

- Estimating affordable loan amounts

- Showing realistic monthly payments

- Comparing FHA vs conventional loans

- Understanding long-term interest impact

This makes the home-buying process more transparent and less stressful.

Home Loan Calculator with Interest and Mortgage Rates USA

Mortgage rates in the USA change frequently. A home loan calculator with interest USA allows you to test different current mortgage rates and see how they affect your payment.

Even a small change in interest rate can add or reduce thousands of dollars in total loan cost. That’s why using a calculator is essential before locking in a rate.

Benefits of Using an Online Home Loan Interest Calculator

- Free and easy to use

- Instant payment estimates

- Helps compare mortgage offers

- Improves financial decision-making

- Ideal for budgeting and planning

Using a calculator gives you confidence before speaking with lenders.

Are Home Loan Calculators with Interest Accurate?

Home loan calculators provide estimates, not exact figures. Actual mortgage payments depend on lender fees, taxes, insurance, and loan approval terms. However, these calculators are highly accurate for planning and comparison.

Tips to Reduce Home Loan Interest Costs

- Improve your credit score

- Make a larger down payment

- Choose a shorter loan term

- Compare mortgage rates from multiple lenders

- Consider refinancing when rates are lower

A home loan calculator with interest helps you test these strategies easily.

Final Thoughts

A Home Loan Calculator with Interest is an essential tool for anyone planning to buy or refinance a home in the United States. It helps estimate monthly payments, understand interest costs, and compare loan options before making a financial commitment.

Using this calculator puts you in control of your mortgage journey and helps you make informed, confident decisions.

Post Comment