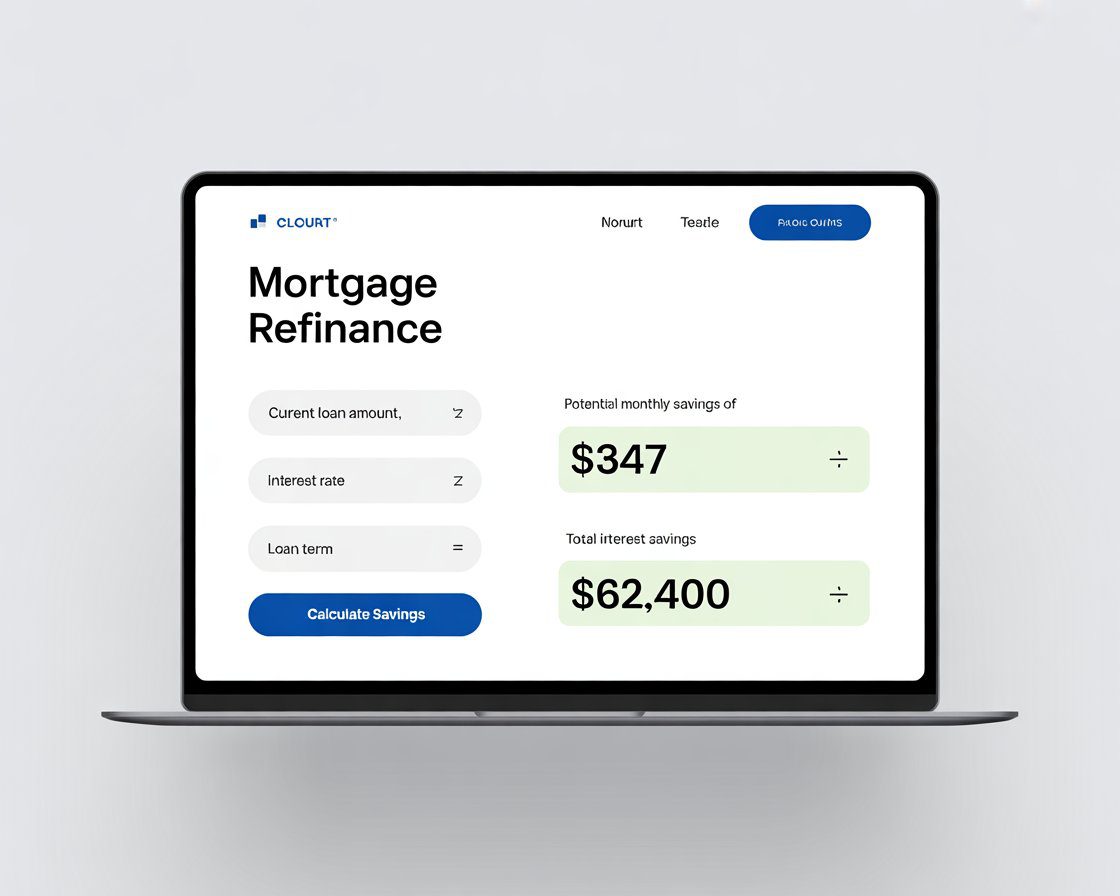

Refinance Mortgage Calculator – See How Much You Can Save by Refinancing Your Home Loan

Refinancing a mortgage can be a smart financial move, but only if it truly saves you money. A Refinance Mortgage Calculator is an essential tool that helps homeowners estimate new monthly payments, interest savings, and long-term benefits before refinancing a home loan.

Whether you want to lower your monthly payment, reduce your interest rate, shorten your loan term, or take cash out of your home equity, using a refinance mortgage calculator allows you to make informed decisions with confidence.

What Is a Refinance Mortgage Calculator?

A Refinance Mortgage Calculator is an online tool that helps you compare your current mortgage with a new refinanced loan. It calculates potential savings by analyzing interest rates, loan terms, and remaining loan balance.

The calculator typically considers:

- Current loan balance

- Current interest rate

- New interest rate

- Loan term (15-year or 30-year)

- Closing costs

- Cash-out amount (if applicable)

Using a refinance mortgage calculator USA, homeowners can quickly determine whether refinancing is worth it.

Why Use a Refinance Mortgage Calculator?

Refinancing without proper calculations can be risky. A mortgage refinance calculator helps you:

1. Lower Monthly Mortgage Payments

Estimate how much your monthly payment could drop after refinancing.

2. Calculate Interest Savings

See how much interest you can save over the life of the loan.

3. Compare Loan Terms

Compare a 30-year refinance vs a 15-year refinance.

4. Decide the Right Time to Refinance

Evaluate whether current mortgage rates make refinancing beneficial.

How Does a Refinance Mortgage Calculator Work?

Refinance Mortgage Calculator and Break-Even Analysis

A refinance mortgage calculator is most valuable when it shows the break-even point. This tells you how long it will take for your monthly savings to recover refinancing costs.

Why break-even matters:

- Helps avoid short-term refinancing mistakes

- Confirms if refinancing makes sense for your stay period

- Shows real savings timeline

If you plan to stay in your home beyond the break-even point, refinancing is usually a smart move.

Refinance Mortgage Calculator for Adjustable-Rate Mortgages (ARM)

Homeowners with adjustable-rate mortgages can use a refinance mortgage calculator to compare switching to a fixed-rate loan.

Key benefits:

- Predictable monthly payments

- Protection from rising interest rates

- Easier long-term budgeting

A calculator helps estimate how much you save by locking in a fixed rate.

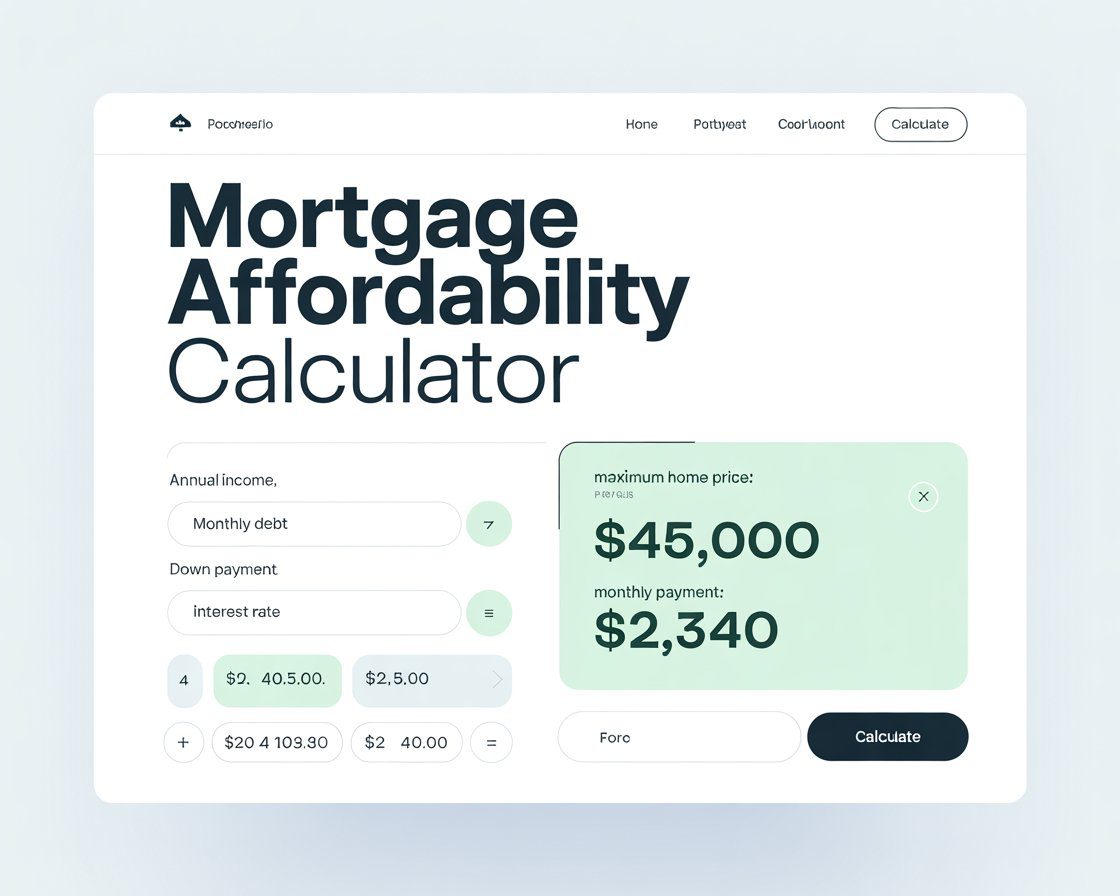

Refinance Mortgage Calculator and Home Equity Growth

Refinancing isn’t only about lowering payments—it also affects equity.

Using a refinance mortgage calculator helps you:

- Track faster principal payoff

- Compare equity growth between loan terms

- Decide between cash-out vs rate refinance

This is useful for long-term financial planning.

Should You Refinance Now or Wait?

A refinance mortgage calculator allows homeowners to test multiple scenarios.

Consider refinancing now if:

- Rates are lower than your current loan

- Your credit score improved

- Home value increased

Waiting may be better if:

- You plan to sell soon

- Break-even period is too long

Running multiple scenarios gives clarity.

Homeowner FAQ: Refinance Mortgage Calculator

Neeche wali lines use karo jahan keyword repeat ho raha ho:

- This mortgage refinance calculator helps estimate monthly savings.

- A reliable home refinance calculator compares loan terms easily.

- Using an online refinancing calculator, homeowners can plan better.

- Mortgage calculators allow users to test different interest rates.

How often should I use a refinance mortgage calculator?

Use it whenever mortgage rates change or your financial situation improves.

Does using a refinance calculator affect my credit score?

No. Calculators are free tools and do not impact your credit.

Can I refinance more than once?

Yes, but frequent refinancing may increase long-term costs.

Conversion Boost Tip (Optional Section)

Add a short CTA after this section:

“Try our free Refinance Mortgage Calculator to see how much you could save today.”

This improves engagement and monetization.

A home refinance calculator compares two scenarios:

- Your existing mortgage

- Your new refinanced mortgage

It calculates:

- New monthly mortgage payment

- Total interest paid over time

- Break-even point (when savings exceed closing costs)

This helps you determine if refinancing aligns with your financial goals.

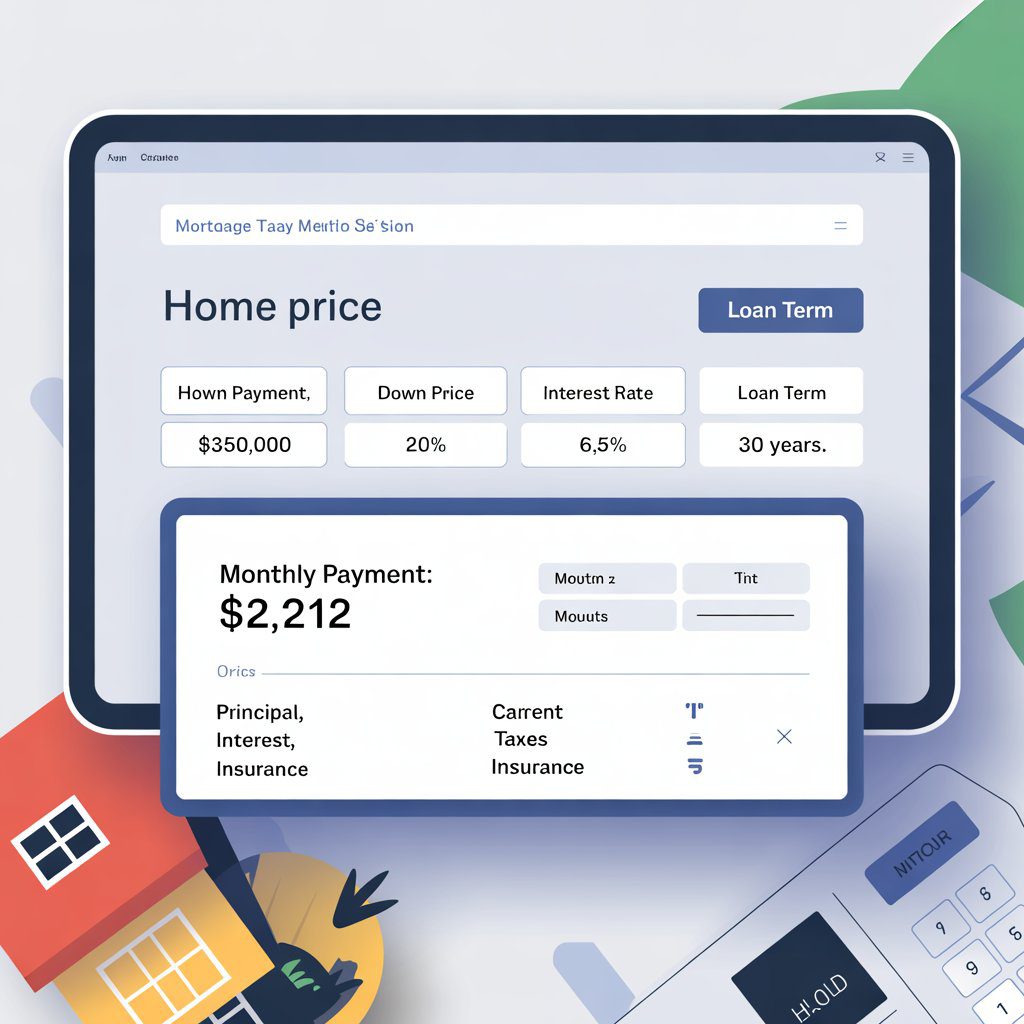

Refinance Mortgage Calculator Example

Here is a simple refinance example:

Current Mortgage

- Loan balance: $250,000

- Interest rate: 7.25%

- Remaining term: 25 years

- Monthly payment: $1,710

Refinanced Mortgage

- New interest rate: 6.0%

- Loan term: 30 years

Using a refinance mortgage calculator, the new estimated monthly payment may be around $1,500, saving about $210 per month.

This example shows how refinancing at a lower rate can significantly reduce monthly costs.

Types of Refinance Mortgage Calculators

1. Rate-and-Term Refinance Calculator

Helps refinance to a lower rate or different loan term.

2. Cash-Out Refinance Calculator

Estimates payments when taking cash from home equity.

3. FHA Refinance Calculator

Includes FHA streamline refinance options.

4. VA Refinance Calculator

Designed for VA IRRRL and VA cash-out refinance loans.

5. Break-Even Refinance Calculator

Shows how long it takes to recover closing costs.

When Should You Use a Refinance Mortgage Calculator?

A refinance mortgage calculator USA is useful when:

- Mortgage rates drop

- Your credit score improves

- You want to shorten your loan term

- You need lower monthly payments

- You want to access home equity

Using a calculator before contacting lenders helps you avoid unnecessary refinancing costs.

Refinance Mortgage Calculator and Current Mortgage Rates USA

Mortgage rates in the USA change daily. A refinance mortgage calculator allows homeowners to test different current mortgage rates USA and see how rate changes affect savings.

Even a small reduction in interest rate (0.5%–1%) can save thousands of dollars over the life of the loan.

Benefits of Using a Refinance Mortgage Calculator Online

- Free and easy to use

- Instant refinance estimates

- Helps avoid costly mistakes

- Supports smart financial planning

- Ideal for homeowners and investors

Using a calculator puts you in control before committing to refinancing.

Refinance Mortgage Calculator for Cash-Out Refinancing

A cash-out refinance mortgage calculator helps homeowners determine:

- How much cash they can take out

- New loan balance

- New monthly payment

This option is often used for home renovations, debt consolidation, or major expenses.

Refinance Mortgage Calculator for Shorter Loan Terms

Many homeowners refinance to switch from a 30-year loan to a 15-year loan. A refinance mortgage calculator helps compare:

- Higher monthly payments

- Lower total interest paid

- Faster home equity buildup

This strategy works well for borrowers with stable income.

Factors That Affect Refinance Mortgage Calculations

1. Interest Rate

Lower rates increase savings potential.

2. Loan Balance

Higher balances offer more refinance savings.

3. Closing Costs

Closing costs impact the break-even point.

4. Credit Score

Better credit qualifies for lower refinance rates.

5. Loan Term

Longer terms reduce payments but increase total interest.

Are Refinance Mortgage Calculators Accurate?

Refinance mortgage calculators provide estimates, not final loan terms. Actual refinance offers depend on lender fees, credit score, property value, and market conditions. However, calculators are highly accurate for comparison and planning.

Tips to Maximize Refinance Savings

- Shop for the best refinance rates

- Improve your credit score

- Compare multiple lenders

- Avoid refinancing too frequently

- Use a refinance mortgage calculator before applying

These steps help ensure refinancing truly benefits you.

Refinance Mortgage Calculator vs Mortgage Pre-Approval

A refinance calculator helps with planning, while refinance pre-approval confirms lender eligibility. Using both gives you a complete picture of your refinance options.

Refinance Mortgage Calculator for Bad Credit Borrowers

Even homeowners with less-than-perfect credit can benefit from using a refinance mortgage calculator. While bad credit may result in slightly higher refinance rates, a calculator helps estimate whether refinancing still makes financial sense.

Key points for bad credit borrowers:

- Compare FHA refinance vs conventional refinance

- Test different interest rates to see realistic savings

- Calculate break-even point before applying

Using a refinance mortgage calculator first prevents unnecessary credit checks and rejected applications.

Refinance Mortgage Calculator: 15-Year vs 30-Year Refinance

A refinance mortgage calculator is especially useful when comparing loan terms.

30-Year Refinance

- Lower monthly payments

- More interest paid over time

- Better for cash-flow flexibility

15-Year Refinance

- Higher monthly payments

- Much lower total interest

- Faster home equity growth

The calculator clearly shows long-term savings so homeowners can choose the right option based on income and goals.

How to Use a Refinance Mortgage Calculator Step-by-Step

Many users don’t use calculators correctly. Follow these steps for accurate results:

- Enter your current loan balance

- Input your existing interest rate

- Choose a new refinance rate

- Select loan term (15 or 30 years)

- Add estimated closing costs

- Review monthly payment & break-even point

This method ensures realistic refinance estimates.

Refinance Mortgage Calculator for Investment Properties

Homeowners with rental or investment properties can also use a refinance mortgage calculator USA to estimate returns.

Benefits include:

- Lower monthly mortgage expenses

- Improved cash flow

- Ability to fund new investments

- Tax planning advantages (consult a tax advisor)

Rates for investment properties are usually higher, making calculator comparisons even more important.

Common Mistakes to Avoid When Using a Refinance Mortgage Calculator

Avoid these errors to get accurate results:

- Ignoring closing costs

- Using unrealistic interest rates

- Forgetting remaining loan term

- Not calculating break-even time

- Refinancing too often

A refinance mortgage calculator works best when realistic data is used.

Final Thoughts

A Refinance Mortgage Calculator is one of the most powerful tools for homeowners looking to reduce mortgage costs, lower interest rates, or access home equity. It helps you estimate savings, compare loan options, and decide whether refinancing is the right move.

Before refinancing your home loan, always use a refinance mortgage calculator to avoid surprises and make confident financial decisions.

Post Comment