Mortgage Affordability Calculator – How Much House Can You Afford in the USA?

Buying a home is an exciting milestone, but one of the biggest questions every buyer asks is: How much house can I afford? This is where a Mortgage Affordability Calculator becomes an essential tool. It helps you estimate the home price you can comfortably afford based on your income, expenses, and current mortgage rates.

Whether you are a first-time home buyer, upgrading to a new home, or planning to refinance, using a mortgage affordability calculator allows you to make informed and confident financial decisions.

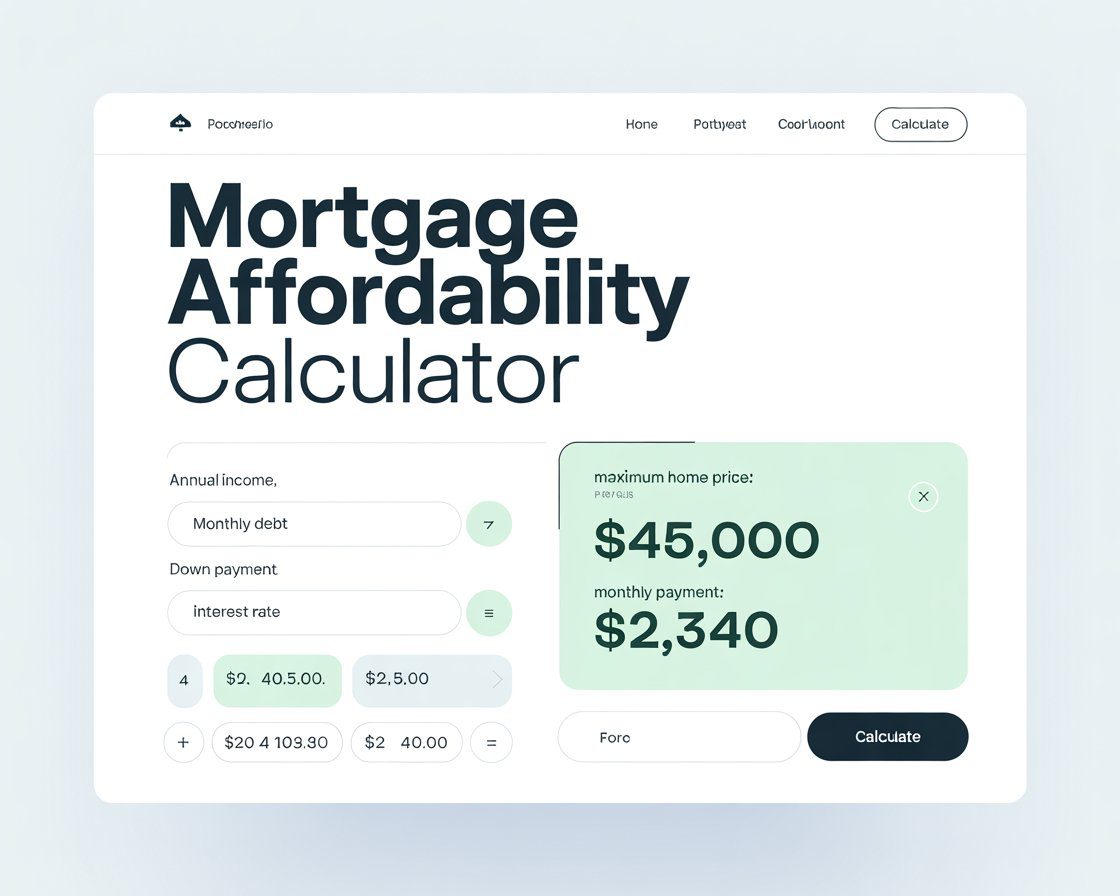

What Is a Mortgage Affordability Calculator?

A Mortgage Affordability Calculator is an online tool designed to estimate how much home you can afford without putting financial stress on your budget. Instead of guessing, the calculator uses your financial details to provide a realistic home price range.

It typically considers:

- Annual household income

- Monthly debts and expenses

- Down payment amount

- Interest rate

- Loan term (15-year or 30-year mortgage)

Using a mortgage affordability calculator USA, buyers can avoid overborrowing and choose a home that fits their lifestyle.

Why Use a Mortgage Affordability Calculator?

Using a home affordability calculator offers several key benefits:

1. Know Your Budget Before You Buy

The calculator clearly answers the question “How much house can I afford?”

2. Avoid Financial Stress

It helps you avoid monthly payments that are too high for your income.

3. Plan Smarter

You can plan your down payment, savings, and future expenses more effectively.

4. Compare Loan Options

Test different mortgage rates, loan terms, and down payment scenarios.

How Does a Mortgage Affordability Calculator Work?

A mortgage affordability calculator uses basic lending guidelines followed by most lenders in the USA. One common rule is the 28/36 rule:

- Housing costs should not exceed 28% of your gross monthly income

- Total debt payments should not exceed 36% of your income

By applying these rules, the calculator estimates an affordable monthly mortgage payment and converts it into a home price range.

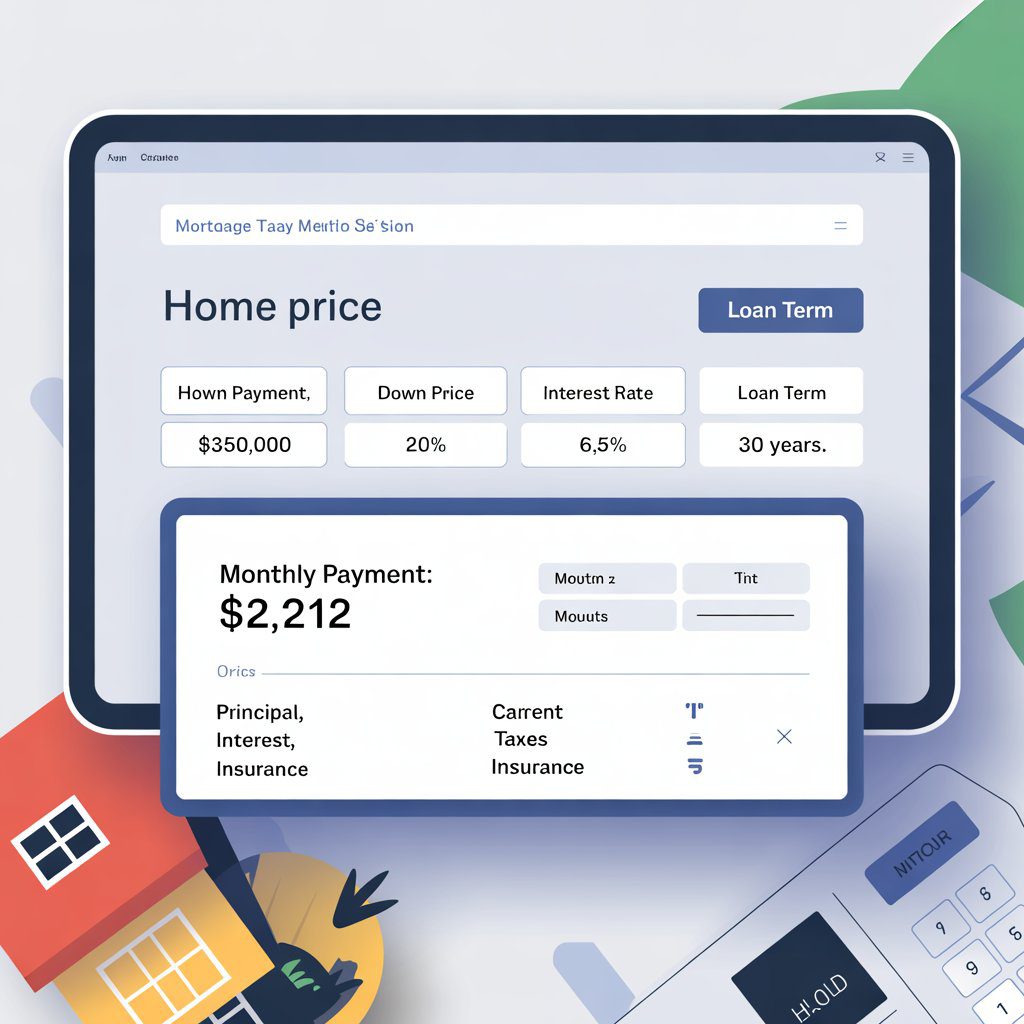

Mortgage Affordability Calculator Example

Let’s look at a simple example:

- Annual household income: $90,000

- Monthly debt payments: $500

- Down payment: $50,000

- Interest rate: 6.5%

- Loan term: 30 years

Using a mortgage affordability calculator USA, you may find that you can afford a home priced around $380,000 to $420,000, depending on taxes and insurance.

This example shows how income, debt, and interest rates directly impact affordability.

Key Factors That Affect Mortgage Affordability

1. Income

Higher income increases the home price you can afford.

2. Monthly Debts

Car loans, student loans, and credit cards reduce affordability.

3. Down Payment

A larger down payment lowers your loan amount and monthly payment.

4. Interest Rates

Higher mortgage rates reduce buying power, while lower rates increase affordability.

5. Loan Term

A 30-year mortgage allows higher affordability due to lower monthly payments.

Mortgage Affordability Calculator for First-Time Home Buyers

First-time buyers often struggle to determine a realistic budget. A mortgage affordability calculator for first-time buyers helps by:

- Showing affordable price ranges

- Estimating monthly payments

- Understanding low down payment options

- Comparing FHA vs conventional loans

This tool is especially useful for buyers with limited savings or moderate income.

Mortgage Affordability Calculator with Taxes and Insurance

A mortgage affordability calculator with taxes and insurance provides a more accurate estimate by including:

- Property taxes

- Homeowners insurance

- HOA fees (if applicable)

These costs are often overlooked but can significantly impact affordability.

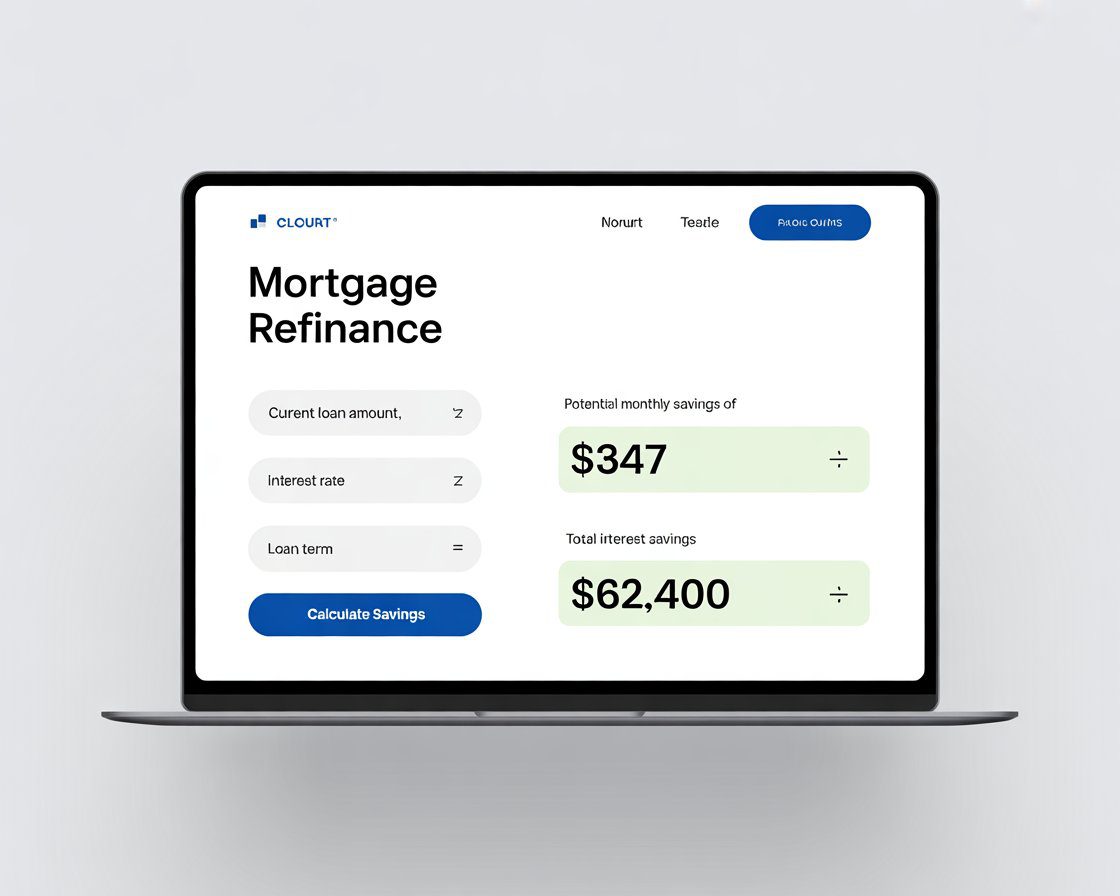

Mortgage Affordability Calculator and Mortgage Rates USA

Mortgage rates in the USA change frequently. A mortgage affordability calculator USA allows buyers to test different current mortgage rates and see how rate changes affect home affordability.

Even a small increase in interest rates can reduce your affordable home price by tens of thousands of dollars.

Mortgage Affordability vs Pre-Approval

A mortgage affordability calculator helps with planning, while mortgage pre-approval is the lender’s official confirmation of how much they may lend.

Using both together is the best strategy:

- Calculator = budget planning

- Pre-approval = buying power confirmation

Benefits of Using an Online Mortgage Affordability Calculator

- Free and easy to use

- Instant affordability estimates

- Helps avoid overborrowing

- Improves financial confidence

- Ideal for first-time and repeat buyers

This tool puts buyers in control before speaking with lenders.

Tips to Increase Your Mortgage Affordability

- Pay down existing debts

- Improve your credit score

- Save for a larger down payment

- Choose a longer loan term

- Compare mortgage rates from multiple lenders

A mortgage affordability calculator helps you test each of these strategies.

Are Mortgage Affordability Calculators Accurate?

Mortgage affordability calculators provide estimates, not guarantees. Actual loan approval depends on lender requirements, credit score, and financial documentation. However, calculators are highly accurate for budgeting and early planning.

Final Thoughts

A Mortgage Affordability Calculator is one of the most important tools for anyone planning to buy a home in the United States. It helps you understand your budget, estimate affordable home prices, and make confident financial decisions.

Before starting your home search, always use a mortgage affordability calculator to avoid surprises and stay within a comfortable budget.

Post Comment